Solar power systems can range from $3,500-$35,000, with the average American spending $16,000 to begin benefitting from renewable energy. The good news is you can save thousands of dollars through federal rebates and incentives. They can even pay for themselves if you own them long enough! If you’re thinking about taking action with renewable energy, these incentives can help you save money on your project and get a faster return on your investment.

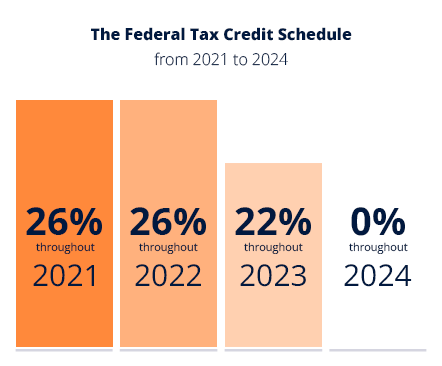

The federal solar tax credit is the best incentive for going green with Proxima Solar Energy. The government has been encouraging property owners to invest in renewable energy by offering tax breaks of 26% when they file their income tax with the IRS. That means when you buy a solar power system for $16,000, you’ll be saving $4,160 in a dollar-for-dollar reduction against your federal income tax.

Unless Congress renews this incentive, it’ll be reduced to 22% for systems installed in 2023 and unavailable as of 2024.

The Federal tax credit isn’t a refund that gets deposited into your bank account. Instead, it’s subtracted from any income tax you owe for the year. As of 2022, you’ll be credited 26% of the cost of your solar power system. This includes not only the cost of the panels but also the installation fees and a home battery to store the energy you’ll need to tap into from time to time.

In order for your battery to be included in the cost of the tax credit, you’ll need to prove that it’s renewable. The way to do this is by demonstrating you own your home solar system, and it’s the only source of energy that powers the home battery.

While the tax credit alone is a great incentive to move to renewable energy, you reap more rewards depending on where you live.

In addition to the Federal Income Tax Credit, several states offer further incentives for renewable energy. California, Texas, Minnesota, and New York include the highest number of incentives across the country. To find out your state’s status on incentives, check the Database of State Incentives for Renewables & Efficiency.

State tax credits function similarly to the federal income tax credit. The only difference is that they directly apply to state taxes, not your federal ones. The exact amount offered varies from state to state. You can usually combine the state tax credits with the federal ones for twice the advantage when purchasing a solar power system.

In some states, you may be eligible for an upfront rebate if you install a solar power system. They’re usually only offered for a limited period while funds for the incentive last. It’s worth looking into rebates in your state to take advantage of the offer before it expires. Solar expenses can be reduced by 10% to 20% with a state government rebate.

Another state-level solar incentive is a Solar Renewable Energy Certificate (SREC), sometimes known as a Solar Renewable Energy Credit. After you build your solar power system and register it with the proper state authorities, they will track its energy output and provide you with SRECs on a regular basis. You can sell your SREC to your local energy utility (or another buyer) for a payout that is often tax-deductible.

The incentives don’t stop at the tax credits, both federal and state-wide. Property owners benefit from their low utility bills but can also take advantage of a few more solar rewards.

Subsidized loans may be available from your state, local utility, or another non-government group to assist you in funding the purchase of your solar panel installation. Before buying your system, talk to Proxima Solar Energy about discounted loan options in your area.

Local utilities frequently offer financial incentives to encourage residents to install solar panels. Some companies give energy bill rebates based on how much electricity the system generates, while others provide one-time incentives to install solar panels. PBIs, or performance-based incentives, are incentives that give you a per-kilowatt-hour credit for the electricity your system generates.

You may be eligible for tax exemptions in addition to tax credits if you install a solar system. Despite the fact that these systems will raise the value of your home, some states and municipalities will not include them in their property tax assessments; thus, your property tax payment will not increase as a result of solar installation.

Some states offer programs that eliminate all purchases of solar power system components from state sales taxes, potentially saving you hundreds of dollars when it comes time to install your system.

You can save thousands of dollars on your solar power system installation by combining these numerous solar tax credits and other benefits. While installing one may be intimidating to pay for upfront, these incentives will help you save a lot of money in the long run.

Proxima Solar Energy helps you harness the power of the sun. Sustainable energy is designed for your lifestyle and is within reach with affordable credits and incentives. Contact us for a complimentary quote to bring renewable energy to your home.